Mutual funds, Bullions and certificates

what are mutual funds?

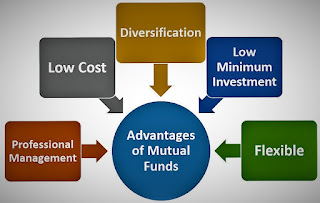

a mutual fund is a pool of money provided by individual investors, companies, and other organizations. A fund manager is hired to invest the cash the investors have contributed, and the fund manager's goal depends on the type of fund; a fixed-income fund manager, for example, would strive to provide the highest yield at the lowest risk. Mutual funds give small or individual investors access to professionally managed portfolios of equities, bonds and other securities. Each shareholder, therefore, participates proportionally in the gains or losses of the fund.

Mutual funds pool money from the investing public and use that money to buy other securities, usually stocks and bonds. The value of the mutual fund company depends on the performance of the securities it decides to buy. So, when you buy a unit or share of a mutual fund, you are buying the performance of its portfolio or more precisely, a part of the portfolio's value.

|

| Mutual funds |

what is bullion?

Bullion is gold, silver, or other precious metals in the form of bars, ingots, or specialized coins. Typically, bullion is used for trade on a market. The word "bullion" comes from the old French word bouillon, which meant "boiling", and was the term for the activity of a melting house. The value of bullion is typically determined by the value of its precious metals content, which is defined by its purity and mass. To assess the purity of gold bullion, the centuries-old technique of fire assay is still employed, together with modern spectroscopic instrumentation, to accurately determine its quality to ensure the owner receives fair market value for it. It is also weighed extremely accurately.

Coins:

Coins and bars are strictly for those who have a place to put them like a safety deposit box or safe. Certainly, for those who are expecting the worst, bullion is the only option, but for investors with a time horizon, bullion is illiquid and downright bothersome to hold.

Certificates:

Certificates offer investors all the benefits of physical gold ownership without the hassle of transportation and storage. That said, if you're looking for insurance in a real disaster, certificates are just paper. Don't expect anyone to take them in exchange for anything of value.

I really impressed after read this because of some quality work and informative thoughts . I just wanna say thanks for the writer and wish you all the best for coming!. https://bayfront.com.sg/venture-capital-singapore/

ReplyDelete