Options, Call & Put options, futures

Option –

the right to buy or sell a futures contract at a particular price. The right to buy a futures contract is called a Call Option. The right to sell a futures contract is called a Put Option. The price chosen for which to buy or sell is called the Strike Price. The price paid for the right is called the Option Premium.

Example of Call option order: Buy one contract November wheat call - €250 strike at €15 premium.

Example of Call option order: Buy one contract November wheat call - €250 strike at €15 premium.

Call Option

A contract which gives the purchaser the right, though not the obligation, to purchase the underlying security at a specific price within a specific time frame

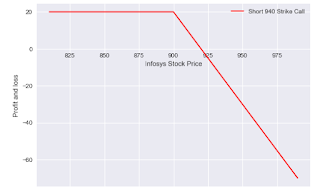

Suppose the Infosys is currently trading at INR 900. A trader thinks that the current price of Infosys is undervalued and expected to increase in the future. In this case, he buys the call option of Infosys and pays a premium to the call seller.

Suppose the price of Infosys increases to INR 1000 at expiry. Then the buyer will exercise the option since he has the right to exercise. In this case, the call buyer will buy the Infosys stock from the seller at INR 1000 and seller is obligated to sell at INR 1000 as per the agreement. The net profit of the call buyer is (INR 1000 - INR 900)-premium

If the stock price decreases below INR 900 at expiry, then the call buyer will lose the premium he paid to the call seller.

Suppose the Infosys is currently trading at INR 900. A trader thinks that the current price of Infosys is undervalued and expected to increase in the future. In this case, he buys the call option of Infosys and pays a premium to the call seller.

Suppose the price of Infosys increases to INR 1000 at expiry. Then the buyer will exercise the option since he has the right to exercise. In this case, the call buyer will buy the Infosys stock from the seller at INR 1000 and seller is obligated to sell at INR 1000 as per the agreement. The net profit of the call buyer is (INR 1000 - INR 900)-premium

If the stock price decreases below INR 900 at expiry, then the call buyer will lose the premium he paid to the call seller.

Put Option

A contract which gives the buyer the right, but not the obligation, to sell a certain quantity of an underlying security to the writer of the option, at a specific price within specified period of time. The term "put" comes from the fact that the owner has the right to "put up for sale" the stock or index.Not take the same example where the Infosys is currently trading at INR 900. But this time trader thinks that the current price of Infosys is overvalued and expected to decrease in the future. So in this case, he buys the put option and pays a premium to the put seller.

Suppose the stock price drops to INR 800. In this case, the buyer buys the stock from the stock market at INR 800 and sells it to the seller at INR 900 (the strike price). According to the agreement, the seller is obligated to purchase the stock of Infosys at INR 900 from the buyer. Seller then goes to the stock market and sells the Infosys’s stock at INR 800. So the net profit for the buyer is (INR 900 - INR 800)-premium.

futures

A term used to designate all contracts covering the purchase and sale of financial instruments or physical commodities for future delivery on a commodity futures exchange.

What Are Futures?

Futures markets trade futures contracts. A futures contract is an agreement between a buyer and seller of the contract that some asset--such as a commodity, currency or index--will bought/sold for a specific price, on a specific day, in the future (expiration date).

For example, if someone buys a July crude oil futures contract (CL), they are saying they will buy 1,000 barrels of oil from the seller at the price they pay for the futures contract, come the July expiry. The seller is agreeing to sell the buyer the 1,000 barrels of oil at the agreed upon price.

Comments

Post a Comment